Shutterstock/Boule

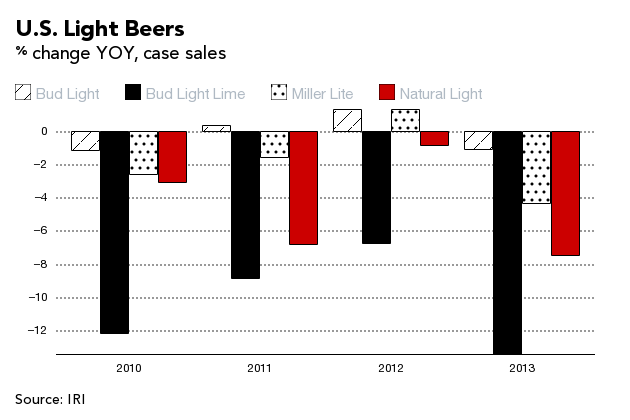

Shutterstock/Boule Bud Light may still be America's best-selling beer -- it has been for more than a decade -- but retail sales of this and other leading lower-calorie lagers such as Bud Light Lime, Miller Lite, and Natural (aka Natty) Light, declined in 2013, according to data from IRI, a Chicago market research firm.  Not that this spells the end of light beers, which still make up a significant chunk of the market. Even as big brewers push into the craft segment, some big-name labels are still experiencing an uptick. Case sales of Coors Light, which became the No. 2 beer brand in the U.S. in 2012, grew nearly 1.8 percent last year, according to IRI. Michelob Ultra Light sales were also up, although it is an outlier in a fast-declining Michelob franchise. "There will always be a place for 'Big Lager' as it's more drinkable in the sense that one can have many lagers but only a few dark beers," says Euromonitor International analyst Edward Hsyeh. "The dark beers are heavy in body, so there can only be so much 'share of the stomach' they possess."

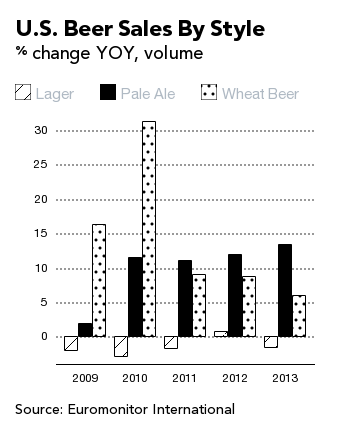

Not that this spells the end of light beers, which still make up a significant chunk of the market. Even as big brewers push into the craft segment, some big-name labels are still experiencing an uptick. Case sales of Coors Light, which became the No. 2 beer brand in the U.S. in 2012, grew nearly 1.8 percent last year, according to IRI. Michelob Ultra Light sales were also up, although it is an outlier in a fast-declining Michelob franchise. "There will always be a place for 'Big Lager' as it's more drinkable in the sense that one can have many lagers but only a few dark beers," says Euromonitor International analyst Edward Hsyeh. "The dark beers are heavy in body, so there can only be so much 'share of the stomach' they possess."  Still, big challenges loom: First, Americans' growing thirst for darker, more flavorful brews can't be ignored. Volume sales of lager-a lighter style of beer-have fallen every year since 2009 except 2012, according to Euromonitor's data, though the vast majority of beer consumed in the U.S. is still lager. Sales of pale ales, on the other hand, were up by 13 percent in 2013 alone, and wheat beer grew by 6 percent. The shift is reflected in the recent craft beer boom (volume sales grew 13 percent in the first half of 2013) in which India Pale Ale has become popular. Second, aside from craft, the big brands are seeing competition from imports, too. Modelo Especial volume sales, for example, more than doubled since 2009, according to IRI, and sales of Corona were up 11 percent. Last, hard ciders and new beer-like varieties such as AB InBev's (BUD) Bud Light Lime Straw-Ber-Rita, which sold more than 7 million cases since launching last year, are stealing market share. AB InBev said in its last earnings report that "the Ritas" (Bud Light Lime Straw-Ber-Rita and Bud Light Lime Lime-A-Rita) achieved a combined market share of 0.8 percent in the third quarter of 2013. AB InBev, which owns Bud and Natural, declined to comment because it's in a quiet period ahead of its next earnings report. MillerCoors, a joint venture between SABMiller and Molson Coors (TAP), reported that sales to retailers fell 2.8 percent in 2013, due to declines in such premium light brands as Miller Lite and in value brands that include Miller High Life and Keystone. Molson Coors Chief Financial Officer Gavin Hattersley said at a conference last year that beer drinkers are simply "looking for more flavors, they're looking for more options than ever before." Meanwhile, sales of Milwaukee's "the beast" Best haven't done any better.

Still, big challenges loom: First, Americans' growing thirst for darker, more flavorful brews can't be ignored. Volume sales of lager-a lighter style of beer-have fallen every year since 2009 except 2012, according to Euromonitor's data, though the vast majority of beer consumed in the U.S. is still lager. Sales of pale ales, on the other hand, were up by 13 percent in 2013 alone, and wheat beer grew by 6 percent. The shift is reflected in the recent craft beer boom (volume sales grew 13 percent in the first half of 2013) in which India Pale Ale has become popular. Second, aside from craft, the big brands are seeing competition from imports, too. Modelo Especial volume sales, for example, more than doubled since 2009, according to IRI, and sales of Corona were up 11 percent. Last, hard ciders and new beer-like varieties such as AB InBev's (BUD) Bud Light Lime Straw-Ber-Rita, which sold more than 7 million cases since launching last year, are stealing market share. AB InBev said in its last earnings report that "the Ritas" (Bud Light Lime Straw-Ber-Rita and Bud Light Lime Lime-A-Rita) achieved a combined market share of 0.8 percent in the third quarter of 2013. AB InBev, which owns Bud and Natural, declined to comment because it's in a quiet period ahead of its next earnings report. MillerCoors, a joint venture between SABMiller and Molson Coors (TAP), reported that sales to retailers fell 2.8 percent in 2013, due to declines in such premium light brands as Miller Lite and in value brands that include Miller High Life and Keystone. Molson Coors Chief Financial Officer Gavin Hattersley said at a conference last year that beer drinkers are simply "looking for more flavors, they're looking for more options than ever before." Meanwhile, sales of Milwaukee's "the beast" Best haven't done any better.

No comments:

Post a Comment