Auto parts retailers like large cap O'Reilly Automotive Inc (NASDAQ: ORLY) and mid cap Advance Auto Parts, Inc (NYSE: AAP)�along with small cap auto parts stock Federal-Mogul Corp (NASDAQ: FDML) have been a bright spot on the economy as consumers try to stretch the lives of their automobiles or vehicles in the bad or uncertain economy. In fact, Investors Business Daily has recently noted that the�average age of cars on the road is about 11.5 years and that�� of course good news for auto parts retailers while�any uptick in sales or production of auto parts in general�will be good for companies like Federal-Mogul Corp. With that in mind, here�is a look at�how these three auto parts retailers or auto parts stocks are taking investors for a ride in a good way:

O'Reilly Automotive Inc. Founded in 1957 by the O'Reilly family, O'Reilly Automotive is one of the largest specialty retailers of automotive aftermarket parts, tools, supplies, equipment and accessories in the United States, serving both the do-it-yourself and professional service provider markets. As of June 30, the company operated 4,087 stores in 42 states. Yesterday, O'Reilly Automotive reported an 8% revenue increase to $1.73 billion while net income increased 17% to $186 million for the 19th consecutive quarter of 15% or greater adjusted diluted earnings per share growth. O'Reilly Automotive is on�target to open 190 net new stores in 2013 and plans to increase new store growth in 2014 to 200 new stores. In addition, the company has $360 million remaining under its current share repurchase authorization. However, it should also be mentioned that O'Reilly Automotive�� cash�tends to be�locked in inventories while current and long term liabilities has been steadily increasing over the past few quarters according to Google Finance data���something investors should keep an eye on.�In addition, many of its stores are concentrated in certain regions of the country which could make the country vulnerable to economic fluctuations in those regions. On Wednesday, large cap O'Reilly Automotive rose 0.40% to $134.31 (ORLY has a 52 week trading range of $79.24 to $135.62 a share) for a market cap of $14.58 billion plus the stock is up 52.4% since the start of the year, up 66.7% over the past year and up 497.7% over the past five years.

Top Specialty Retail Companies To Buy For 2014: Ulta Salon Cosmetics and Fragrance Inc (ULTA)

Ulta Salon, Cosmetics & Fragrance, Inc. (Ulta), incorporated on January 9, 1990, is a beauty retailer, which provides one-stop shopping for prestige, mass and salon products and salon services in the United States. During the year ended January 28, 2012 (fiscal 2011), the Company opened 61 new stores. It operates full-service salons in all of its stores. Its Ulta store format includes an open and modern salon area with approximately eight to 10 stations. The entire salon area is approximately 950 square feet with a concierge desk, skin treatment room, semi-private shampoo and hair color processing areas. Each salon is a full-service salon offering hair cuts, hair coloring and permanent texture, with salons also providing facials and waxing.

The Company offers products in the categories, such as cosmetics, which includes products for the face, eyes, cheeks, lips and nails; haircare, which includes shampoos, conditioners, styling products, and hair accessories; salon styling tools, which includes hair dryers, curling irons and flat irons; skincare and bath and body, which includes products for the face, hands and body; fragrance for both men and women; private label, consisting of Ulta branded cosmetics, skincare, bath and body products and haircare, and other, including candles, home fragrance products and other miscellaneous health and beauty products. The Company has combined its three operating segments: retail stores, salon services and e-commerce, into one reportable segment.

The Company competes with Macy��, Nordstrom, Sephora, Bath & Body Works, CVS/pharmacy, Walgreens, Target, Wal-Mart, Regis Corp., Sally Beauty and JCPenney salons.

Advisors' Opinion: - [By Teresa Rivas]

Ulta Salon (ULTA) jumped more than 13% after its second quarter beat estimates and raised its full year comparable sales guidance.

Safeway (SWY) was up nearly 4% after an upgrade to Outperform at Credit Suisse, which also upgraded lululemon (LULU), sending shares up 1%, and downgraded Under Armour (UA)��hares were down 1.6%.

- [By Dan Caplinger]

Finally, beyond the Dow, the end of earnings season and M&A activity continued to move stocks. Ulta Salon (NASDAQ: ULTA ) has soared 15.6% after it released favorable results, including same-store sales gains of 6.7% and a 23% increase in overall revenue. Somewhat weak guidance for the current quarter wasn't enough to slow the stock's advance. Meanwhile, Cooper Tire (NYSE: CTB ) launched 40% higher after getting a $35 per-share buyout bid from Indian company Apollo Tyres. If companies see value even as the stock market pauses or corrects, then further acquisition activity could well spur the market's bull run onward.

- [By Lisa Levin]

Ulta Salon, Cosmetics & Fragrance (NASDAQ: ULTA) shares rose 7.73% to $96.43. The volume of Ulta Salon shares traded was 708% higher than normal. Ulta Salon reported better-than-expected fourth-quarter earnings. Ulta Salon posted its quarterly earnings of $1.09 per share, beating analysts' estimates of $1.07 per share.

- [By Jake L'Ecuyer]

Equities Trading UP

Ulta Salon, Cosmetics & Fragrance (NASDAQ: ULTA) shares shot up 7.17 percent to $95.93 after the company reported better-than-expected fourth-quarter earnings. Ulta Salon posted its quarterly earnings of $1.09 per share, beating analysts' estimates of $1.07 per share.

Top Specialty Retail Companies To Buy For 2014: Puget Technologies Inc (PUGE)

PUGET TECHNOLOGIES, INC., incorporated on March 17, 2010, is a development-stage company. The Company is engaged in the distribution of luxury wool bedding sets produced in Germany. The Company�� product includes Lama Wool, Camel Wool, Cashmere Wool and Merino Wool.

The Company�� Lama Wool is consists of 50% Lama Wool hair, and 50% Merino wool hair. The Camel wool is consists of 50% Camel wool hair, and 50% Merino wool hair. The Cashmere wool is blended with Merino wool.

Advisors' Opinion: - [By Peter Graham]

Small cap stocks Inscor, Inc (OTCMKTS: IOGA), Puget Technologies Inc (OTCBB: PUGE) and PTA Holdings Inc (OTCMKTS: PTAH) have all been getting some attention lately in various investment newsletters or investor alerts. However, two of these small caps have been the subject of paid promotions while the third is getting attention largely because its in the growing marijuana or cannabis business. With that in mind, are these stocks really all that hot or not? Here is a quick reality check:

Natural Grocers by Vitamin Cottage, Inc., incorporated on April 9, 2012, is a specialty retailer of natural and organic groceries and dietary supplements. The Company operates within the natural products retail industry. The Company offers products and brands, including a selection of natural and organic food, dietary supplements, body care products, pet care products and books.

The Company offers its customers an average of approximately 18,000 store-keeping units (SKUs) of natural and organic products per store, including an average of approximately 7,000 SKU of dietary supplements. As of June 30, 2012, the Company operated 55 stores in 11 states, including Colorado, Idaho, Kansas, Missouri, Montana, Nebraska, New Mexico, Oklahoma, Texas, Utah and Wyoming, as well as a bulk food repackaging facility and distribution center in Colorado. The size of its stores varies from 5,000 selling square feet to 14,500 selling square feet, and a new store averages 9,500 selling square feet.

Advisors' Opinion: - [By John Udovich]

Small cap Natural Grocers by Vitamin Cottage (NYSE: NGVC) and mid cap Sprouts Farmers Market Inc (NASDAQ: SFM) are taking aim at natural and organic foods supermarket giant Whole Foods Market (NASDAQ: WFM), but do either of these stocks have what it takes to take on the the king of organic retailing? Whole Foods Market was founded in Austin way back in 1978 by a�twenty-five year old college dropout and a twenty-one year old�at a time when there were only a handful of natural or organic�supermarkets in the country. Today, Whole Foods Market�has 364 stores in the United States, Canada and the United Kingdom���which are sometimes referred to as ��hole Wallet��r ��hole Paycheck��given how much it costs to shop there.

- [By David Mamos]

The Fresh Market Inc. (Nasdaq: TFM), Natural Grocers by Vitamin Cottage Inc. (NYSE: NGVC), and privately held Trader Joe's are others crowding into the field.

Top Specialty Retail Companies To Buy For 2014: CSS Industries Inc (CSS)

CSS Industries, Inc. (CSS), incorporated on November 5, 1923, is a company primarily engaged in the design, manufacture, procurement, distribution and sale of seasonal and all occasion social expression products, principally to mass market retailers. These seasonal and all occasion products include gift wrap, gift bags, gift boxes, gift card holders, boxed greeting cards, gift tags, decorative tissue paper, decorations, classroom exchange Valentines, decorative ribbons and bows, floral accessories, Halloween masks, costumes, make-up and novelties, Easter egg dyes and novelties, craft and educational products, stickers, memory books, stationery, journals, notecards, infant and wedding photo albums, scrapbooks, and other gift items that commemorate life�� celebrations. In September 5, 2012, it sold the Halloween portion of its Paper Magic business to Gemmy Industries (HK) Limited.

CSS��product provides its retail customers the opportunity to use a single vendor for much of their seasonal product requirements. A substantial portion of CSS��products are manufactured, packaged and/or warehoused in 10 facilities located in the United States, with the remainder purchased primarily from manufacturers in Asia and Mexico. The Company�� products are sold to its customers by national and regional account sales managers, sales representatives, product specialists and by a network of independent manufacturers��representatives. The Company�� principal operating subsidiaries include Paper Magic Group, Inc. (Paper Magic), Berwick Offray LLC (Berwick Offray) and C.R. Gibson, LLC (C.R. Gibson). CSS designs, manufactures, procures, distributes and sells a range of seasonal consumer products primarily through the mass market distribution channel. Christmas products include gift wrap, gift bags, gift boxes, gift card holders, boxed greeting cards, gift tags, decorative tissue paper and decorations. CSS��Valentine product offerings include classroom exchange Valentine cards and other related Valen! tine products, while its Easter product offerings include Dudley�� brand of Easter egg dyes and related Easter seasonal products. CSS also designs and markets decorative ribbons and bows, all occasion boxed greeting cards, gift wrap, gift bags, gift boxes, gift card holders, decorative and waxed tissue, decorative films and foils, stickers, memory books, stationery, journals, notecards, infant and wedding photo albums, scrapbooks, floral accessories and other gift and craft items to its mass market, craft, specialty and floral retail and wholesale distribution customers, and teachers' aids and other learning oriented products to the education market through mass market retailers, school supply distributors and teachers' stores. Key brands include Paper Magic, Berwick, Offray, C.R. Gibson, Markings, Creative Papers, Tapestry, Dudley��, Don Post Studios, Eureka, Learning Playground, Stickerfitti and iota. Key brands include Paper Magic, Berwick, Offray, C.R. Gibson, Markings, Creative Papers, Tapestry, Seastone, Dudley��, Eureka, Learning Playground and Stickerfitti.

CSS operates 10 manufacturing and/or distribution facilities located in Pennsylvania, Maryland, New Hampshire, South Carolina, Alabama and Texas. Its boxed greeting cards are produced by Asian manufacturers to the Company�� specifications. Halloween make-up and Easter egg dye products are manufactured in Asia to specific formulae by contract manufacturers who meet regulatory requirements for the formularization and packaging of such products. Ribbons and bows are primarily manufactured and warehoused in seven facilities located in Pennsylvania, Maryland, South Carolina and Texas. Memory books, stationery, journals and notecards, infant and wedding photo albums, scrapbooks, and other gift items are imported from Asian manufacturers and warehoused and distributed from a distribution facility in Florence, Alabama. Floral accessories, including pot covers, foil, waxed tissue, shred, aisle runners, corsage bags and other paper! and film! products, are manufactured in a facility located in Milford, New Hampshire and Juarez, Mexico. Manufacturing includes gravure and flexo printing, waxing and converting. Products are warehoused and distributed from a distribution facility in Berwick, Pennsylvania. Other products including, but not limited to, decorative tissue paper, all occasion gift wrap, gift tags, gift bags, gift boxes, gift card holders, classroom exchange Valentine products, Halloween masks, costumes and novelties, Easter products, decorations and school products are designed to the specifications of CSS and are imported primarily from Asian manufacturers.

Advisors' Opinion: Top Specialty Retail Companies To Buy For 2014: Vitamin Shoppe Inc (VSI)

Vitamin Shoppe, Inc., incorporated on September 27, 2002, is a specialty retailer and direct marketer of vitamins, minerals, herbs, specialty supplements, sports nutrition and other health and wellness products. During the fiscal year ended December 29, 2012 (fiscal 2012), the Company marketed over 400 different brands, as well as its own brands, which include Vitamin Shoppe, BodyTech and True Athlete. The Company sells its products through two segments: retail and direct. In the Company's retail segment, the Company had a total of 286 new stores during the fiscal 2012. As of January 26, 2013, the Company operated 579 stores in 42 states, the District of Columbia, Puerto Rico and Ontario, Canada, primarily located in high-traffic regional retail centers. In the Company's direct segment, the Company sells its products directly to consumers through the Internet, primarily at www.vitaminshoppe.com. On February 14, 2013, Vitamin Shoppe Mariner, Inc. acquired Super Supplements, Inc.

Retail

The Company's retail segment includes its retail store format. Its retail stores are is located in diverse geographic and demographic markets, ranging from urban locations in New York City, to suburban locations in Plantation, Florida and Manhattan Beach, California. As of January 26, 2013, the Company leased the property for all of its 579 stores. The Company's primary warehouse and distribution center and corporate headquarters are consolidated into a leased, 230,000 square-foot facility.

Products

The Company offers a selection of vitamins, minerals, herbs, homeopathic remedies, specialty supplements, such as fish oil, probiotics, glucosamine and Co Q10, sports nutrition, weight management, as well as natural bath and beauty, pet supplements and options for a healthy home. The Company's offers includes approximately 17,500 stock keeping units (SKUs) from over 400 brands. The Company offers products to its assortment in its Vitamin Shoppe, BodyTech, True Athlete and O! ptimal Pet brands, which include products, such as Ultimate Man, Ultimate Women, Whey Tech Pro 24 and Natural Whey Protein. The Company also offers an assortment from national brands, such as Optimum Nutrition, USP Labs, Garden of Life, Cytosport, Nature's Way, Solaray and Solgar. This assortment is designed to provide the Company's customers with a selection of available product in order to help them achieve their health and wellness goals.

The vitamin and mineral product category includes multi-vitamins, which many consider to be a foundation of a healthy regimen, lettered vitamins, such as Vitamin A, C, D, E, and B-complex, along with trace minerals, such as calcium, magnesium, chromium and zinc. Certain herbs can be taken to help support specific body systems, including ginkgo to support brain activity and milk thistle to help support liver function, as well as other less common herbs, such as holy basil for stress support and blood sugar control and black cohosh for menopause support. Herbal products include whole herbs, standardized extracts, herb combination formulas and teas.

Categories of specialty supplements include omega fatty acids, probiotics and condition specific formulas. Certain specialty supplements, such as organic greens, psyllium fiber and soy proteins, are taken for added support during various life stages. Folic acid is specifically useful during pregnancy. Super antioxidants, such as coenzyme Q-10, grapeseed extract and pycnogenol, are taken to address specific conditions. High ORAC (oxygen radical absorptive capacity) fruit concentrates like gogi, mangosteen, pomegranate and blueberry are taken to prevent oxygen radical damage. Other specialty supplement formulas are focused to support specific organs, biosystems and body functions. The Company offers approximately 3,000 SKUs in sports nutrition.

The Company's other category include natural beauty and personal care, diet and weight management supplements, natural pet food, and low carb foo! ds. Natur! al beauty and personal care products offer an alternative to traditional products that often contain synthetic and/or other ingredients that the Company's customers find objectionable. The Company offers approximately 3,000 SKUs for its other category. The Company's natural pet products include nutritionally balanced foods and snacks along with condition specific supplements such as glucosamine for joint health. Its variety of diet and weight management products range from low calorie bars, drinks and meal replacements to energy tablets, capsules and liquids.

The Company competes with Vitamin World, GNC, Whole Foods, Costco, Wal-Mart, Rite-Aid, Walgreens, Amazon.com, Puritan's Pride, Vitacost.com, Bodybuilding.com, Doctors Trust, Swanson and iHerb.

Advisors' Opinion: Top Specialty Retail Companies To Buy For 2014: Barnes & Noble Inc (BKS)

Barnes & Noble, Inc. (Barnes & Noble), incorporated on November 19, 1986, is a bookseller. The Company is a content, commerce and technology company that provides customers access to books, magazines, newspapers and other content across its multi-channel distribution platform. As of April 27, 2013, it operated 1,361 bookstores in 50 states, 686 bookstores on college campuses, and operates one of the Web eCommerce sites, and develops digital content products and software. Barnes & Noble operates in three segments: B&N Retail, B&N College and NOOK. The Company�� principal business is the sale of trade books (generally hardcover and paperback consumer titles), mass market paperbacks (such as mystery, romance, science fiction and other popular fiction), children�� books, eBooks and other digital content, NOOK and related accessories, bargain books, magazines, gifts, cafe products and services, educational toys & games, music and movies direct to customers through its bookstores or on barnesandnoble.com.

Of the Company�� 1,361 bookstores, 675 operate primarily under the Barnes & Noble Booksellers trade name. Barnes & Noble College Booksellers, LLC (B&N College), a wholly owned subsidiary of Barnes & Noble, operates 686 college bookstores at colleges and universities across the United States. Barnes & Noble Retail (B&N Retail) operates the 675 retail bookstores. Retail also includes the Company�� eCommerce site and Sterling Publishing Co., Inc. (Sterling or Sterling Publishing), a leader in general trade book publishing.

B&N Retail

This segment includes 675 bookstores as of April 27, 2013, primarily under the Barnes & Noble Booksellers trade name. These stores generally offer a dedicated NOOK area, a comprehensive trade book title base, a cafe, and departments dedicated to Juvenile, Toys & Games, DVDs, Music, Gift, Magazine and Bargain products. The stores also offer a calendar of ongoing events, including author appearances and children�� activities. The B&! N Retail segment also includes the Company�� eCommerce website, barnesandnoble.com, and its publishing operation, Sterling Publishing. Barnes & Noble stores range in size from 3,000 to 60,000 square feet depending upon market size, with an overall average store size of 26,000 square feet. During the fiscal year ended April 27, 2013 (fiscal), the Company reduced the Barnes & Noble store base by 0.3 million square feet, bringing the total square footage to 17.7 million square feet. The Company�� B&N Retail segment purchases physical books on a regular basis from over 800 publishers and over 50 wholesalers or distributors. As of April 27, 2013, Barnes & Noble had stores in 162 of the total 210 Designated Market Area markets.

Sterling Publishing is a publisher of non-fiction trade titles. It is a range of non-fiction and illustrated books and kits across a range of imprints, in categories, such as health and wellness, music and culture, food and wine, crafts and photography, puzzles and games, history and current affairs, as well as a children�� books.

B&N College

B&N College sells new and used textbooks in campus bookstores and online. As of April 27, 2013, B&N College operated 686 stores nationwide. The Company�� customer base, which is mainly consisted of students and faculty, can purchase various items from their campus stores, including textbooks and course-related materials, emblematic apparel and gifts, trade books, computer products, NOOK products and related accessories, school and dorm supplies, convenience and cafe items.

As of April 27, 2013, B&N College operates 651 traditional college bookstores and 35 academic superstores, which are generally larger in size, offer cafes and provide a sense of community that engages the surrounding campus and local communities in college activities and culture. The traditional bookstores range in size from 500 to 48,000 square feet. The academic superstores range in size from 8,000 to 75,000 square feet. B&! N College! �� three customer constituencies are students, faculty members and campus administrators.

NOOK

This segment includes the Company�� digital business, which includes the Company�� eBookstore, digital newsstand and sales of NOOK devices and accessories to third party distribution partners, as well as to B&N Retail and B&N College. Barnes & Noble�� NOOK digital bookstore and Reading Apps provide customers the ability to purchase and read their digital content and access to their Lifetime Library on a range of digital platforms, including Windows 8 PCs and tablets, iPad, iPhone , Android smartphones and tablets, PC and Mac. Barnes & Noble has implemented features on its digital platform to ensure that customers can access their NOOK content from almost all of today�� most popular devices.

The Company competes with Target, Books-A-Million, Waldenbooks, Amazon.com, Apple, Wal-Mart and Costco.

Advisors' Opinion: - [By Johanna Bennett]

I don�� think this was on Barnes & Noble�� (BKS) Christmas list. The SEC is investigating the book seller�� accounting, including its recent decision to restate earnings for the 2011 and 2012 fiscal years, according to regulatory filings. The Wall Street Journal has the story.

Barnes & Noble said it was notified by the SEC on Oct. 16 that the commission had started an investigation into the company’s restatement of earnings, announced on July 29. On that day, Barnes & Noble said in a filing that it had restated its previous financial statements for the years ending April 28, 2012, and April 30, 2011, “in order to correct previously reported amounts.”

The company said it had “incorrectly overstated certain accruals for the periods prior to April 27, 2013,” related to its distribution center.

Additionally, in a filing on Thursday, the company said that after a review of deferred tax assets and liabilities, it had “concluded” that a deferred tax liability should be reversed.

The bookseller said it is cooperating with the SEC investigation. A Barnes & Noble spokeswoman declined further comment. A spokesman for the SEC also declined to comment.

The news pounded a stock on what is otherwise a big day for equity markets. At $15.15, Barnes & Noble fell 7.6%.

Top Specialty Retail Companies To Buy For 2014: WH Smith PLC (SMWH)

WH Smith PLC is a United Kingdom-based retail company. The Company has two businesses divisions: Travel and High Street. The Company's Travel division sells a range of newspapers, magazines, books and impulse products for people on the move and a broader convenience range in hospitals and workplaces. The Company's High Street sells a wide range of stationery, books, newspapers, magazines and impulse products, as well as a small range of entertainment products.The Company�� subsidiaries include WH Smith PLC, WH Smith Retail Holdings Limited, WH Smith High Street Holdings Limited, WH Smith Travel Holdings Limited, WH Smith High Street Limited, WH Smith Travel Limited and WH Smith Hospitals Holdings Limited.

Advisors' Opinion: Top Specialty Retail Companies To Buy For 2014: Vitacost.com Inc (VITC)

Vitacost.com, Inc. (Vitacost), incorporated in May 20, 1994, is an online retailer of health and wellness products, including dietary supplements such as vitamins, minerals, herbs and other botanicals, amino acids and metabolites, as well as cosmetics, natural personal care products, pet products, sports nutrition and health foods. The Company sells these products directly to consumers primarily through its Website, www.vitacost.com. It offers its customers the selection of healthy living products. It offers its customers a selection of approximately 40,000 Stock Keeping Units (SKUs), from over 2,000 third-party brands, such as New Chapter, Nature�� Way, Twinlab, Source Naturals, Jarrow Formulas, Jason, Desert Essence, Atkins, Bob�� Red Mill, BSN, Optimum Nutrition, USP Labs and MuscleTech in addition to its own brands: Vitacost, Cosmeceutical Sciences Institute (CSI), Best of All, and Smart Basics. As of December 31, 2012, the Company had approximately 2.1 million customers.

The Company offers products in a range of potency levels and dosage forms, such as tablets, capsules, vegi-capsules, softgels, gelcaps, liquids and powders. It offers products that encompass four main categories: Vitamins, Minerals, Herbs and Supplements; Sports Nutrition; Beauty; and Natural and Organic Food.

Vitamins, Minerals, Herbs and Supplements (VMHS)

VMHS products are taken to maintain or improve health and address specific health conditions. In its dietary supplements category, the Company offers its offer its Vitacost branded products as well as third-party brands such as Nature�� Way, Twinlab, Jarrow, Carlson and Rainbow Light. Vitamin and mineral products include multi-vitamins, lettered vitamins, such as Vitamin A, C, D, E and B-complex, along with minerals such as calcium, magnesium, chromium and zinc.

Herbal products include whole herbs, standardized extracts, herb combination formulas and teas. Supplements include essential fatty acids, probiotics, anti-o! xidants, phytonutrients and condition-specific formulas.

Sports Nutrition

Sports nutrition products are used in conjunction with cardiovascular conditioning, weight training and sports activities. Major categories in sports nutrition include protein and weight gain powders, meal replacements, nutrition bars, sport drinks and pre and post-workout supplements. The Company offers bodybuilding and sports products from third parties, such as Optimum Nutrition, CytoSport and BSN as well as our Vitacost branded sports nutrition products.

Beauty

Natural care products consist of a variety of natural products for skin, body, hair and oral health. The Company offers hundreds of natural personal-care products from companies, such as JASON, and Kiss My Face, as well as its CSI-branded products. These products appeal to allergen-conscious and environmentally-conscious consumers seeking products that are made without harsh chemicals and additives.

Natural and Organic Food

Natural and organic food products consist of organic and specialty products such as organic peanut butter, gluten free foods and low mercury tuna and salmon. The Company offers third-party brands, such as Kashi, Eden Foods and Amy�� Organic, as well as its Best of All natural food products.

Under its Vitacost brand, the Company offers over 900 products including multivitamins, minerals, herbs, amino acids, anti-oxidants and others. Under its CSI brand, it markets and sells health and beauty products such as facial cleanser, facial and body moisturizing creams and lotions, and other beauty and skincare products. Under its Best of All brand, it markets and sells organic food products such as banana chips, trail mix, almonds, cashews and more. Under its Smart Basics brand, it markets and sells organic fruit juices and extracts and related dietary supplements. Under its Walker Diet brand, it markets and sells low carb powders used to assist in weight loss and ! managemen! t.

Advisors' Opinion: - [By Seth Jayson]

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Vitacost.com (Nasdaq: VITC ) , whose recent revenue and earnings are plotted below.

- [By Seth Jayson]

Margins matter. The more Vitacost.com (Nasdaq: VITC ) keeps of each buck it earns in revenue, the more money it has to invest in growth, fund new strategic plans, or (gasp!) distribute to shareholders. Healthy margins often separate pretenders from the best stocks in the market. That's why we check up on margins at least once a quarter in this series. I'm looking for the absolute numbers, so I can compare them to current and potential competitors, and any trend that may tell me how strong Vitacost.com's competitive position could be.

Top Specialty Retail Companies To Buy For 2014: Firstin Wireless Technology Inc (FINW)

Firstin Wireless Technology, Inc., formerly Passionate Pet, Inc., incorporated on September 30, 2010, is a mobile service provider. The Company is a software-based mobile service provider that enables enterprises and business users to make affordable and business-quality international long distance and roaming calls over its hybrid mobile VoIP (HY-mVoIPTM) technology. Its service does not replace a user�� existing wireless service, it augments it with global communication capabilities. The Company's application is free to download, and is available on Apple iPhone, Blackberry and Android smartphones.

The Company provides international long distance and roaming services to enterprises and business travelers over smartphones. Business users need to download the Firstin application onto their smartphones to allow them to place and receive international long distance and roaming calls from anywhere in the world for a fixed monthly fee and unlimited usage. The Company intends to revolutionize business mobile communications by spearheading the enterprise mobile VoIP revolution allowing for anywhere, anytime, business-quality and low-cost voice and data communications over smartphones.

Advisors' Opinion: - [By Peter Graham]

A look at SofTech, Inc�� financials reveals revenues of $1,375k (most recent reported quarter), $1,558k, $1,458k and $1,772k for the past four quarters along with net losses of $266k (most recent reported quarter), $51k and $14k and net income of $252k. At the end of August, SofTech, Inc had $828k in cash to cover $2,717k in current liabilities and $5,445k in total liabilities. Given the recent Asset Purchase Agreement and the deal with lenders, it would be good to wait for some more financials to see how SofTech, Inc�� balance sheet has improved.

Firstin Wireless Technology Inc (OTCMKTS: FINW) Has Been Quiet Since February Small cap Firstin Wireless Technology is a mobile communications company that is leading the shift to the enterprise mobile VoIP revolution through its mobile telephony platform and apps, including a flagship Firstin solution that allows for anywhere, anytime mobile communications at significant cost reductions. On Friday, Firstin Wireless Technology closed at $0.255 for a market cap of $8.57 million plus FINW is down 3,087.5% over the past year and down 78.7% since August 2011 according to Google Finance.

- [By Peter Graham]

Small cap stocks Bonamour Inc (OTCBB: BONI), Firstin Wireless Technology Inc (OTCMKTS: FINW) and Microchannel Technologies Corp (OTCBB: MCTC) have been attracting attention from variosu investment newsletters lately with at least two of these stocks being the subject of paid promotions. Of course, there is nothing wrong with properly disclosed paid promotions or investor relation types of activities as its up to investors and traders alike to do their due diligence. So how hot are these small cap stocks? Here is a quick reality check that might cool your appetite:

Top Specialty Retail Companies To Buy For 2014: FTD Companies Inc (FTD)

FTD Companies, Inc. (FTD), incorporated on April 25, 2008, is a floral and gifting company. The Company provides floral, gift and related products and services to consumers and retail florists, as well as to other retail locations offering floral and gift products primarily in the United States, Canada, the United Kingdom, and the Republic of Ireland. The Company operates in one segment, which includes floral and related products and services. Its business uses the FTD and Interflora brands, both supported by the Mercury Man logo. The Company�� portfolio of brands also includes Flying Flowers, Flowers Direct, and Drake Algar in the United Kingdom. On November 1, 2013, United Online, Inc. (United Online) completed the separation of United Online into two independent, publicly traded companies: FTD Companies, Inc. and United Online, Inc.

The Company�� products revenues are derived primarily from selling floral, gift and related products to consumers and the related shipping and service fees. Products revenues also include revenues generated from sales of hard goods, software and hardware systems, cut flowers, packaging and promotional products, and a range of other floral-related supplies to floral network members. Its services revenues related to orders sent through the floral network are variable based on either the number of orders or on the value of orders and are recognized in the period in which the orders.

Advisors' Opinion: - [By John Udovich]

As we head towards Black Friday, small cap specialty retail stocks United Online, Inc (NASDAQ: UNTD), TravelCenters of America LLC (NYSE: TA) and MarineMax, Inc (NYSE: HZO) have the distinction of being the best performing small cap�specialty retail stocks for this year (according to Finviz.com) with gains of 181.2%, 123.8% and 71.8%, respectively. With those returns in mind, what are these small cap specialty retail stocks doing right and will the performance last through the all important holiday season? Here is what new and existing investors and traders alike need to know or consider:

United Online, Inc.�A provider of consumer products and services over the Internet, United Online�� Content & Media segment services are online nostalgia (Memory Lane) and online loyalty marketing (MyPoints) while its�primary Communications segment services are Internet access and email (NetZero and Juno). The reason United Online is among the�best performing specialty retail stocks for this year in various stock screening tools like Finviz.com�is actually misleading as the company has just completed the spin off�of subsidiary FTD Companies, a floral and gifts products company acquired in August 2008 for $441 million, as�FTD Companies Inc (NASDAQ: FTD) where United Online shareholders received one share of FTD common stock for every five shares of United Online common stock they hold. In addition, United Online completed�a�one-for-seven reverse stock split of United Online shares.�On Tuesday, small cap United Online, Inc fell 1.01% to $15.72 (UNTD has a 52 week trading range of $11.65 to $62.30 a share) for a market cap of $207.79 million plus the stock is up 181.2% since the start of the year and up 182.2% over the past five years. Meanwhile, the FTD Companies Inc�now has a�market cap of $611.60 and the stock is up almost 6% since October.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  18.65 (1y: +12%) $(function(){var seriesOptions=[],yAxisOptions=[],name='SNE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1364792400000,16.6],[1364878800000,17],[1364965200000,16.43],[1365051600000,17],[1365138000000,16.69],[1365397200000,17.02],[1365483600000,16.79],[1365570000000,16.93],[1365656400000,16.9],[1365742800000,16.67],[1366002000000,16.48],[1366088400000,16.56],[1366174800000,16.41],[1366261200000,16.18],[1366347600000,16.65],[1366606800000,16.52],[1366693200000,16.67],[1366779600000,16.49],[1366866000000,17.2],[1366952400000,16.48],[1367211600000,16.56],[1367298000000,16.43],[1367384400000,16.25],[1367470800000,16.79],[1367557200000,17.16],[1367816400000,17.13],[1367902800000,17.7],[1367989200000,17.94],[1368075600000,18.08],[1368162000000,17.92],[1368421200000,18.89],[1368507600000,20.76],[1368594000000,20.45],[1368680400000,20.1],[1368766800000,20.34],[1369026000000,20.97],[1369112400000,22.91],[1369198800000,22.15],[1369285200000,21.63],[1369371600000,20.96],[1369717200000,20.67],[1369803600000,20.1],[1369890000000,20.84],[1369976400000,20.15],[1370235600000,19.54],[1370322000000,19.82],[1370408400000,19],[1370494800000,18.96],[1370581200000,19.56],[1370840400000,20.11],[1370926800000,20.3],[1371013200000,20.28],[1371099600000,21.03],[1371186000000,19.88],[1371445200000,20.72],[1371531600000,21.4],[1371618000000,20.49],[1371704400000,20.04],[1371790800000,20.38],[1372050000000,19.94],[1372136400000,20.4],[1372222800000,20.84],[1372309200000,21.2],[1372395600000,21.19],[1372654800000,21.47],[1372741200000,21.81],[1372827600000,21.65],[1373000400000,21.76],[1373259600000,21.61],[1373346000000,21.78],[1373432400000,21.77],[1373518800000,22.2],[1373605200000,22.19],[1373864400000,22.24],[1373950800000,21.96],[1374037200000,22.1],[1374123600000,22.14],[1374210000000,22.11],[1374469200000,22.59],[1374555600000,23.01],[1374642000000,22.81],[1374728400000,22.11],[1374814800000,21.58],[1375074000000,21.24],[1375160400000,21.63],[1375246800000,21.04],[1375333200000,21.96],[1375419600000,2! 1.62],[1375678800000,21.76],[1375765200000,20.72],[1375851600000,20.13],[1375938000000,20.2],[1376024400000,20.15],[1376283600000,20],[1376370000000,20.13],[1376456400000,20.08],[1376542800000,19.86],[1376629200000,19.98],[1376888400000,19.92],[1376974800000,19.95],[1377061200000,19.66],[1377147600000,19.71],[1377234000000,20.21],[1377493200000,20.1],[1377579600000,20.38],[1377666000000,20.16],[1377752400000,20.18],[1377838800000,19.96],[1378184400000,20.41],[1378270800000,20.81],[1378357200000,21.09],[1378443600000,21.02],[1378702800000,21.61],[1378789200000,21.72],[1378875600000,21.42],[1378962000000,21.16],[1379048400000,21.18],[1379307600000,21.46],[1379394000000,21.66],[1379480400000,21.88],[1379566800000,21.63],[1379653200000,21.36],[1379912400000,21.29],[1379998800000,21.37],[1380085200000,21.11],[1380171600000,21.3],[1380258000000,21.29],[1380517200000,21.52],[1380603600000,21.4],[1380690000000,21.2],[1380776400000,20.91],[1380862800000,20.87],[1381122000000,20.27],[1381208400000,19.61],[1381294800000,19.75],[1381381200000,19.57],[1381467600000,19.96],[1381726800000,19.93],[1381813200000,19.7],[1381899600000,19.76],[1381986000000,20.03],[1382072400000,19.61],[1382331600000,19.68],[1382418000000,19.79],[1382504400000,19.48],[1382590800000,19.14],[1382677200000,19.26],[1382936400000,19.51],[1383022800000,19.48],[1383109200000,19.42],[1383195600000,17.25],[1383282000000,16.75],[1383544800000,17.08],[1383631200000,16.85],[1383717600000,17.07],[1383804000000,16.86],[1383890400000,16.74],[1384149600000,16.61],[1384236000000,17.23],[1384322400000,17.94],[1384408800000,18.65],[1384495200000,18.5],[1384754400000,18.72],[1384840800000,18.7],[1384927200000,18.53],[1385013600000,18.65],[1385100000000,18.3],[1385359200000,18.17],[1385445600000,18.16],[1385532000000,18.53],[1385704800000,18.3],[1385964000000,18.6],[1386050400000,18.41],[1386136800000,17.89],[1386223200000,17.79],[1386309600000,18.1],[1386568800000,17.97],[1386655200000,17.62],[1386741600000,17.44],[1386828000000,17.67],[1386914400000,17.51],[! 138717360! 0000,17.5],[1387260000000,17.25],[1387346400000,17.55],[1387432800000,17.48],[1387519200000,17.56],[1387778400000,17.76],[1387864800000,17.45],[1388037600000,17.31],[1388124000000,17.09],[1388383200000,17.46],[1388469600000,17.29],[1388642400000,17.16],[1388728800000,17.18],[1388988000000,17.3],[1389074400000,17.32],[1389160800000,18.25],[1389247200000,18.08],[1389333600000,17.8],[1389592800000,17.55],[1389679200000,17.53],[1389765600000,17.41],[1389852000000,17.21],[1389938400000,17.05],[1390284000000,16.85],[1390370400000,17.11],[1390456800000,16.79],[1390543200000,16.72],[1390802400000,16.23],[1390888800000,16.42],[1390975200000,16.05],[1391061600000,16.13],[1391148000000,15.75],[1391407200000,15.25],[1391493600000,16.1],[1391580000000,15.9],[1391666400000,16.52],[1391752800000,16.82],[1392012000000,16.68],[1392098400000,17.11],[1392184800000,17.32],[1392271200000,17.2],[1392357600000,17.06],[1392703200000,17.34],[1392789600000,17.07],[1392876000000,17.17],[1392962400000,17.12],[1393221600000,17.4],[1393308000000,17.28],[1393394400000,17.38],[1393826400000,17.21],[1393912800000,17.36],[1393999200000,17.48],[1394085600000,17.86],[1394172000000,17.95],[1394427600000,18.04],[1394514000000,17.85],[1394600400000,17.84],[1394686800000,17.63],[1394773200000,17.17],[1395032400000,17.22],[1395118800000,17.15],[1395205200000,17.15],[1395291600000,17.61],[1395378000000,17.76],[1395637200000,17.65],[1395723600000,18.25],[1395810000000,18.05],[1395896400000,18.27],[1395982800000,18.65],[1396152282000,18.65],[1396152282000,18.65],[1396018921000,18.65]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,value){value.setState(0);});series=chart.get('SNE');series.remove();} buttons[0].on('click',function(e){chart.showLoading();reset_all_buttons();chart.rangeSelector.buttons[0].setState(2);var extremes=axis.getExtremes();$.getJSON('/modules/chart/price_chart_json.php?symbol=SNE&ser=1d',function(data){if(data!=null){var extremes=axis.getExtremes();axis.setExtremes(data[1][0][0],data[1][data[1].length-1][0]);chart.addSeries({name:'SNE',id:'SNE',color:'#4572A7',data:data[1]});if(data[0][1]>=0){display=data[0][0]+" (1D: +"+data[0][1]+"%)";reporting.html(display);}else{display=data[0][0]+" (1D: "+data[0][1]+"%)";reporting.html(display);} chart.hideLoading();}});});buttons[1].on('click',functio

18.65 (1y: +12%) $(function(){var seriesOptions=[],yAxisOptions=[],name='SNE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1364792400000,16.6],[1364878800000,17],[1364965200000,16.43],[1365051600000,17],[1365138000000,16.69],[1365397200000,17.02],[1365483600000,16.79],[1365570000000,16.93],[1365656400000,16.9],[1365742800000,16.67],[1366002000000,16.48],[1366088400000,16.56],[1366174800000,16.41],[1366261200000,16.18],[1366347600000,16.65],[1366606800000,16.52],[1366693200000,16.67],[1366779600000,16.49],[1366866000000,17.2],[1366952400000,16.48],[1367211600000,16.56],[1367298000000,16.43],[1367384400000,16.25],[1367470800000,16.79],[1367557200000,17.16],[1367816400000,17.13],[1367902800000,17.7],[1367989200000,17.94],[1368075600000,18.08],[1368162000000,17.92],[1368421200000,18.89],[1368507600000,20.76],[1368594000000,20.45],[1368680400000,20.1],[1368766800000,20.34],[1369026000000,20.97],[1369112400000,22.91],[1369198800000,22.15],[1369285200000,21.63],[1369371600000,20.96],[1369717200000,20.67],[1369803600000,20.1],[1369890000000,20.84],[1369976400000,20.15],[1370235600000,19.54],[1370322000000,19.82],[1370408400000,19],[1370494800000,18.96],[1370581200000,19.56],[1370840400000,20.11],[1370926800000,20.3],[1371013200000,20.28],[1371099600000,21.03],[1371186000000,19.88],[1371445200000,20.72],[1371531600000,21.4],[1371618000000,20.49],[1371704400000,20.04],[1371790800000,20.38],[1372050000000,19.94],[1372136400000,20.4],[1372222800000,20.84],[1372309200000,21.2],[1372395600000,21.19],[1372654800000,21.47],[1372741200000,21.81],[1372827600000,21.65],[1373000400000,21.76],[1373259600000,21.61],[1373346000000,21.78],[1373432400000,21.77],[1373518800000,22.2],[1373605200000,22.19],[1373864400000,22.24],[1373950800000,21.96],[1374037200000,22.1],[1374123600000,22.14],[1374210000000,22.11],[1374469200000,22.59],[1374555600000,23.01],[1374642000000,22.81],[1374728400000,22.11],[1374814800000,21.58],[1375074000000,21.24],[1375160400000,21.63],[1375246800000,21.04],[1375333200000,21.96],[1375419600000,2! 1.62],[1375678800000,21.76],[1375765200000,20.72],[1375851600000,20.13],[1375938000000,20.2],[1376024400000,20.15],[1376283600000,20],[1376370000000,20.13],[1376456400000,20.08],[1376542800000,19.86],[1376629200000,19.98],[1376888400000,19.92],[1376974800000,19.95],[1377061200000,19.66],[1377147600000,19.71],[1377234000000,20.21],[1377493200000,20.1],[1377579600000,20.38],[1377666000000,20.16],[1377752400000,20.18],[1377838800000,19.96],[1378184400000,20.41],[1378270800000,20.81],[1378357200000,21.09],[1378443600000,21.02],[1378702800000,21.61],[1378789200000,21.72],[1378875600000,21.42],[1378962000000,21.16],[1379048400000,21.18],[1379307600000,21.46],[1379394000000,21.66],[1379480400000,21.88],[1379566800000,21.63],[1379653200000,21.36],[1379912400000,21.29],[1379998800000,21.37],[1380085200000,21.11],[1380171600000,21.3],[1380258000000,21.29],[1380517200000,21.52],[1380603600000,21.4],[1380690000000,21.2],[1380776400000,20.91],[1380862800000,20.87],[1381122000000,20.27],[1381208400000,19.61],[1381294800000,19.75],[1381381200000,19.57],[1381467600000,19.96],[1381726800000,19.93],[1381813200000,19.7],[1381899600000,19.76],[1381986000000,20.03],[1382072400000,19.61],[1382331600000,19.68],[1382418000000,19.79],[1382504400000,19.48],[1382590800000,19.14],[1382677200000,19.26],[1382936400000,19.51],[1383022800000,19.48],[1383109200000,19.42],[1383195600000,17.25],[1383282000000,16.75],[1383544800000,17.08],[1383631200000,16.85],[1383717600000,17.07],[1383804000000,16.86],[1383890400000,16.74],[1384149600000,16.61],[1384236000000,17.23],[1384322400000,17.94],[1384408800000,18.65],[1384495200000,18.5],[1384754400000,18.72],[1384840800000,18.7],[1384927200000,18.53],[1385013600000,18.65],[1385100000000,18.3],[1385359200000,18.17],[1385445600000,18.16],[1385532000000,18.53],[1385704800000,18.3],[1385964000000,18.6],[1386050400000,18.41],[1386136800000,17.89],[1386223200000,17.79],[1386309600000,18.1],[1386568800000,17.97],[1386655200000,17.62],[1386741600000,17.44],[1386828000000,17.67],[1386914400000,17.51],[! 138717360! 0000,17.5],[1387260000000,17.25],[1387346400000,17.55],[1387432800000,17.48],[1387519200000,17.56],[1387778400000,17.76],[1387864800000,17.45],[1388037600000,17.31],[1388124000000,17.09],[1388383200000,17.46],[1388469600000,17.29],[1388642400000,17.16],[1388728800000,17.18],[1388988000000,17.3],[1389074400000,17.32],[1389160800000,18.25],[1389247200000,18.08],[1389333600000,17.8],[1389592800000,17.55],[1389679200000,17.53],[1389765600000,17.41],[1389852000000,17.21],[1389938400000,17.05],[1390284000000,16.85],[1390370400000,17.11],[1390456800000,16.79],[1390543200000,16.72],[1390802400000,16.23],[1390888800000,16.42],[1390975200000,16.05],[1391061600000,16.13],[1391148000000,15.75],[1391407200000,15.25],[1391493600000,16.1],[1391580000000,15.9],[1391666400000,16.52],[1391752800000,16.82],[1392012000000,16.68],[1392098400000,17.11],[1392184800000,17.32],[1392271200000,17.2],[1392357600000,17.06],[1392703200000,17.34],[1392789600000,17.07],[1392876000000,17.17],[1392962400000,17.12],[1393221600000,17.4],[1393308000000,17.28],[1393394400000,17.38],[1393826400000,17.21],[1393912800000,17.36],[1393999200000,17.48],[1394085600000,17.86],[1394172000000,17.95],[1394427600000,18.04],[1394514000000,17.85],[1394600400000,17.84],[1394686800000,17.63],[1394773200000,17.17],[1395032400000,17.22],[1395118800000,17.15],[1395205200000,17.15],[1395291600000,17.61],[1395378000000,17.76],[1395637200000,17.65],[1395723600000,18.25],[1395810000000,18.05],[1395896400000,18.27],[1395982800000,18.65],[1396152282000,18.65],[1396152282000,18.65],[1396018921000,18.65]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,value){value.setState(0);});series=chart.get('SNE');series.remove();} buttons[0].on('click',function(e){chart.showLoading();reset_all_buttons();chart.rangeSelector.buttons[0].setState(2);var extremes=axis.getExtremes();$.getJSON('/modules/chart/price_chart_json.php?symbol=SNE&ser=1d',function(data){if(data!=null){var extremes=axis.getExtremes();axis.setExtremes(data[1][0][0],data[1][data[1].length-1][0]);chart.addSeries({name:'SNE',id:'SNE',color:'#4572A7',data:data[1]});if(data[0][1]>=0){display=data[0][0]+" (1D: +"+data[0][1]+"%)";reporting.html(display);}else{display=data[0][0]+" (1D: "+data[0][1]+"%)";reporting.html(display);} chart.hideLoading();}});});buttons[1].on('click',functio

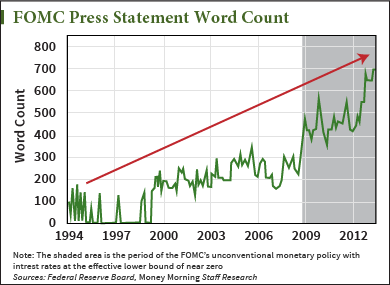

The first Federal Open Market Committee (FOMC) press statement was released on Feb. 4, 1994, and it was all of a whopping 99 words: short, succinct, and to the point.

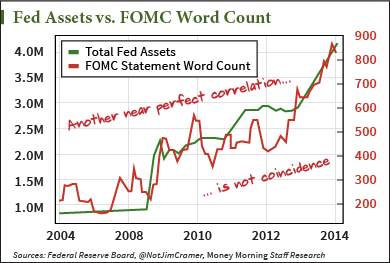

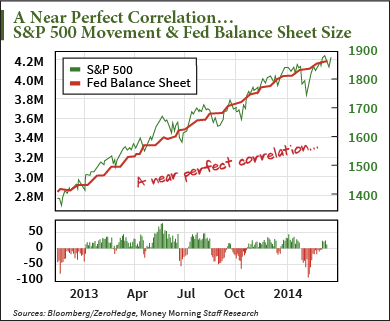

The first Federal Open Market Committee (FOMC) press statement was released on Feb. 4, 1994, and it was all of a whopping 99 words: short, succinct, and to the point. The Fed missed the financial crisis in formation and has been wrong about critical inflation and jobs data for several years in a row now, which means that it's got to "explain" itself in other ways.

The Fed missed the financial crisis in formation and has been wrong about critical inflation and jobs data for several years in a row now, which means that it's got to "explain" itself in other ways. It's one thing to say that the Fed is simply doing a better job of communicating. And entirely another when you realize why...

It's one thing to say that the Fed is simply doing a better job of communicating. And entirely another when you realize why...