Benjamin Graham was Warren Buffett's professor and mentor at Columbia Business School. Buffett even named his son Howard Graham Buffett, after Graham. In the preface to Graham's book, "The Intelligent Investor," Buffett calls it "by far the best book about investing ever written."

Serenity's Benjamin Graham Screener applies Graham's 16 financial criteria to 4,500 NYSE and Nasdaq stocks to find Defensive, Enterprising and NCAV grade Graham stocks today.

Last year, we briefly saw a formula that Graham actually warned against, but is widely used as "The Benjamin Graham Formula." Today, we will look in greater depth into how this confusion came about, what Graham actually wrote and finally, some stocks that meet the more complex formulas that Graham actually did recommend.

The Wrong Intrinsic Value Formula

The formula itself is mentioned in "Chapter 11: Security Analysis for the Lay Investor" of Graham's seminal book, "The Intelligent Investor," as:

Value = Current (Normal) Earnings X� (8.5 plus twice the expected annual growth rate)

Top Warren Buffett Companies To Own In Right Now: Hoku Corporation(HOKU)

Hoku Corporation operates as a solar energy products and services company primarily in the United States. It focuses on manufacturing polysilicon, a primary material used in the manufacture of photovoltaic (PV) modules; and designing, engineering, and installing turnkey PV systems and related services in Hawaii using solar modules purchased from third-party suppliers. The company was formerly known as Hoku Scientific, Inc. and changed its name to Hoku Corporation in March 2010. Hoku Corporation was incorporated in 2001 and is headquartered in Honolulu, Hawaii.

Top Warren Buffett Companies To Own In Right Now: Clearbridge Energy MLP Total Return Fund Inc (CTR)

NA

Interdigital, Inc. engages in the design and development of digital wireless technology solutions. The company offers technology solutions for use in digital cellular and wireless products and networks, including 2G, 3G, 4G, and IEEE 802-related products and networks. It holds patents related to the fundamental technologies that enable wireless communications. The company licenses its patents to equipment producers that manufacture, use, and sell digital cellular and IEEE 802-related products; and licenses or sells mobile broadband modem solutions, including modem IP, know-how, and reference platforms to mobile device manufacturers, semiconductor companies, and other equipment producers that manufacture, use, and sell digital cellular products. InterDigital?s solutions are incorporated in various products comprising mobile devices, such as cellular phones, tablets, notebook computers, and wireless personal digital assistants; wireless infrastructure equipment, such as base stations; and components, dongles, and modules for wireless devices. The company was founded in 1972 and is headquartered in King of Prussia, Pennsylvania.

Advisors' Opinion: - [By Alex Planes]

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does InterDigital (NASDAQ: IDCC ) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

- [By Evan Niu, CFA]

What: Shares of InterDigital (NASDAQ: IDCC ) have gotten crushed today by as much as 20% after the company lost a patent suit against several smartphone makers.

- [By CRWE]

InterDigital, Inc. (NASDAQ:IDCC) reported that certain of its subsidiaries have completed the previously announced sale of roughly 1,700 patents and patent applications to Intel Corporation for $375 million in cash.

Top Warren Buffett Companies To Own In Right Now: Cross Timbers Royalty Trust (CRT)

Cross Timbers Royalty Trust operates as an express trust in the United States. The company holds 90% net profits interests in various royalty and overriding royalty interest properties in Texas, Oklahoma, and New Mexico. It also holds 11.11% nonparticipating royalty interests in nonproducing properties located primarily in Texas and Oklahoma; and 75% net profits working interests in 7 oil-producing properties, including 4 properties in Texas and 3 properties in Oklahoma. Cross Timbers Royalty Trust was founded in 1991 and is based in Dallas, Texas.

Top Warren Buffett Companies To Own In Right Now: Emgold Mining Corporation (EMR.V)

Emgold Mining Corporation engages in the exploration of mineral properties. It explores for gold, tungsten, molybdenum, silver, and other minerals. The company focuses on the permitting and development of the Idaho-Maryland Mine, which is located in Grass Valley, California. Its exploration properties include the Buckskin Rawhide and Koegel Rawhide gold properties in Nevada; and the Stewart and Rozan poly-metallic properties in British Columbia. The company was formerly known as Emperor Gold Corporation and changed its name to Emgold Mining Corporation in August 1997. Emgold Mining Corporation was founded in 1989 and is based in Vancouver, Canada.

Top Warren Buffett Companies To Own In Right Now: Latchways(LTC.L)

Latchways plc engages in the production, distribution, and installation of industrial safety products and related services primarily in Europe and North America. It operates in two segments, Safety Products and Safety Services. The Safety Products segment designs and manufactures fall protection equipment for people working at height. It offers systems for those working at height, including on rooftops, crane rails; and systems for those climbing to or from height, such as ladders, telecom masts, and electricity transmission towers, as well as provides personal protective equipment, guardrails, and walkways. This segment sells its products directly, as well as through independent installers. The Safety Services segment installs and services safety products under the ManSafe name. The company?s products are used in bridges, commercial, electricity pylons, heritage, industrial, towers, office blocks, manufacturing plants, entertainment arenas, public buildings, offshore pla tforms, aerospace, power transmission, utilities, and telecommunications applications. Latchways plc was founded in 1974 and is headquartered in Devizes, the United Kingdom.

Top Warren Buffett Companies To Own In Right Now: Marani Brands Inc (MRIB)

Marani Brands, Inc. (Marani), incorporated on May 30, 2001, is engaged in the importation and sale of alcoholic beverage products, primarily Marani Vodka, its flagship product. The Company�� primary business is the business of Margrit Enterprises International, Inc. (MEI), which is in the distribution of wine and spirit products manufactured in Armenia. Marani Vodka is made from winter wheat harvested in Armenia, distilled three times, aged in oak barrels lined with honey and skimmed dried milk, then filtered 25 times. Bottling of the product occurs at the Eraskh distillery in Armenia. On April 4, 2008, the Company, FFBI Merger Sub Corp. and MEI executed, and on April 7, 2008, the parties closed, a three party Merger Agreement.

The Company purchases all of its products from a single supplier, Eraskh Winery, Ltd., under an exclusive distribution agreement with Eraskh, an Armenian manufacturer of wine and other spirits. The new bottles for Marani Vodka are being manufactured in France by Saver Glass Company and China by Universal Group Co., Ltd. and shipped to Armenia to be filled at Eraskh. The Company�� product is being distributed by Southern Wine & Spirits of America, Inc. (SWS), in Southern California, in conjuction with PLCB Pennsylvania and Nevada. SWS is an alcoholic beverage distributor in the United States. The Company has established additional distributors, such as QV Distributors in Arizona and Wein-Baur in Illinois.

The Company competes with Diageo, Pernod Ricard, Bacardi and Brown-Forman.

Top Warren Buffett Companies To Own In Right Now: Titanium Metals Corporation(TIE)

Titanium Metals Corporation produces and sells titanium melted and mill products. It provides titanium sponge, which is the basic form of titanium metal used in titanium products; melted products, including ingots, electrodes, and slabs that are the result of melting titanium sponge and titanium scrap; mill products, which are forged and rolled from ingot or slab products, comprising billets, bars, plates, sheets, strips, and pipes; and fabrications, such as spools, pipe fittings, manifolds, and vessels, as well as offers titanium scrap and titanium tetrachloride. The company serves commercial aerospace and military, chemical process, oil and gas, consumer, sporting goods, healthcare, automotive and power generation sectors. It distributes its products through its sales force in the United States and Europe, as well as through independent agents and distributors internationally. The company was founded in 1950 and is based in Dallas, Texas.

Tesla Model S: Test drive D.C. to Boston

Tesla Model S: Test drive D.C. to Boston ![]()

The drug development process is dauntingly complex. It often takes years of laboratory work to identify a potentially promising compound, which then must endure at least a few years of preliminary testing before clinical trials are even started.

The drug development process is dauntingly complex. It often takes years of laboratory work to identify a potentially promising compound, which then must endure at least a few years of preliminary testing before clinical trials are even started. [ Enlarge Image ]

[ Enlarge Image ] Reuters C’est ne pas une Norfolk Southern train.

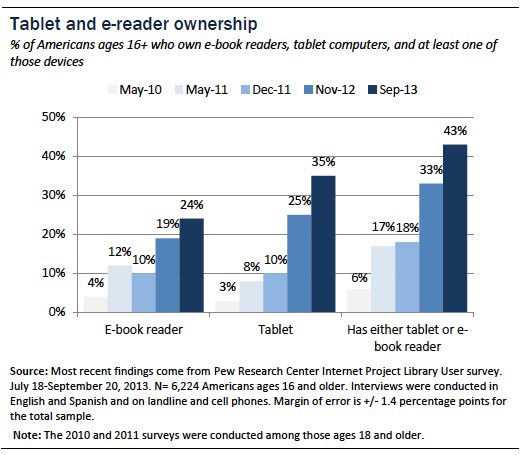

Reuters C’est ne pas une Norfolk Southern train.  Source: Pew Internet & American Life Project

Source: Pew Internet & American Life Project Alamy A few years ago -- back during that economic crisis -- I wrote a piece about the most disgusting ways to save money. At the time, the piece was something of a joke, a tongue-in-cheek look at some of the extremes that people could go to to trim expenses and increase income. Not long afterward, the unemployment rate started dropping, the economy's slow recovery chugged along, and suddenlyusing fingernail clippings to scrub your pots or eating rodents seemed a little ... well, extreme. Fast forward five years: Unemployment is still high, wages are depressed, and the benefits of the recovery have largely accrued to the nation's wealthiest citizens. And now, even with the government shutdown over and a debt default dodged -- for now -- it's clear that we can't always count on the social safety net programs of the federal government. To put it mildly, extreme savings techniques are starting to seem a little more relevant. Other commodities' values may rise and fall, but there's one that tends to retain its worth: the human body. And, while it's illegal to sell one's organs in this country, several other parts of you can fetch a pretty penny on the open market. In a recent piece for Salon.com, Victoria Stillwell looked at some of the top methods people are using to raise money. For anyone familiar with "Les Miserables," some of the top items shouldn't seem all that surprising: some of Stillwell's interviewees reported selling their hair, a few considered selling their breast milk, and she noted that thousands of women have looked into selling their eggs. While not as invasive as selling, say, a kidney, all of these are fairly intense ways to make a buck. At the least, they involve collecting breast milk and putting it in the mail; at the most, they involve a series of uncomfortable hormone treatments and painful ovum collection procedures. Even so, all three methods are gaining popularity as it's getting harder and harder to make money through more traditional means. It's unclear how much longer Stillwell's big three methods for raising cash will continue to grow in popularity. Indeed, we should all hope that, before long, they'll seem anachronistic, unnecessary, and, well, a little extreme.

Alamy A few years ago -- back during that economic crisis -- I wrote a piece about the most disgusting ways to save money. At the time, the piece was something of a joke, a tongue-in-cheek look at some of the extremes that people could go to to trim expenses and increase income. Not long afterward, the unemployment rate started dropping, the economy's slow recovery chugged along, and suddenlyusing fingernail clippings to scrub your pots or eating rodents seemed a little ... well, extreme. Fast forward five years: Unemployment is still high, wages are depressed, and the benefits of the recovery have largely accrued to the nation's wealthiest citizens. And now, even with the government shutdown over and a debt default dodged -- for now -- it's clear that we can't always count on the social safety net programs of the federal government. To put it mildly, extreme savings techniques are starting to seem a little more relevant. Other commodities' values may rise and fall, but there's one that tends to retain its worth: the human body. And, while it's illegal to sell one's organs in this country, several other parts of you can fetch a pretty penny on the open market. In a recent piece for Salon.com, Victoria Stillwell looked at some of the top methods people are using to raise money. For anyone familiar with "Les Miserables," some of the top items shouldn't seem all that surprising: some of Stillwell's interviewees reported selling their hair, a few considered selling their breast milk, and she noted that thousands of women have looked into selling their eggs. While not as invasive as selling, say, a kidney, all of these are fairly intense ways to make a buck. At the least, they involve collecting breast milk and putting it in the mail; at the most, they involve a series of uncomfortable hormone treatments and painful ovum collection procedures. Even so, all three methods are gaining popularity as it's getting harder and harder to make money through more traditional means. It's unclear how much longer Stillwell's big three methods for raising cash will continue to grow in popularity. Indeed, we should all hope that, before long, they'll seem anachronistic, unnecessary, and, well, a little extreme. AFP

AFP  Hosted by Marketfy

Hosted by Marketfy  Get Benzinga's News Delivered Free

Get Benzinga's News Delivered Free

Alamy When I was growing up, no one ever called me a princess. My parents told me I was smart, funny, powerful and kind, but never "princess." Mom handed me a Nerf gun and dad taught me how to shoot a layup. I'd wander into my parent's room to see my father ironing his suit pants for work while my mother sat at her desk paying the bills. There were no bedtime stories about helpless girls who needed to be rescued. Instead, there were lessons about how I could rescue myself through education and financial literacy. The first lesson came in the summer of 1996, when my father took money right out of my 7-year-old hands. My jaw dropped in indignation and my Pocahontas sneakers stamped the ground. I demanded he hand over my fairly earned cash. After all, I had been the one who woke up at 6 a.m. to set up my Fisher-Price table to sell Krispy Kreme doughnuts. Embracing the entrepreneurial spirit young, I had seized upon my mother's yard sale as the perfect opportunity to venture into the business world and hone my sales technique. My 4-year-old sister and I sold doughnuts at the marked-up price of 50 cents apiece to the bargain hunters while my mom peddled our old goods. I felt I'd earned my $18. With a chuckle over my childish rage, my dad told me I owed my sister $2 in wages for helping me sell those doughnuts. Then, he took his cut. As he counted out the quarters I owed him, he explained that he had staked me the money to buy the doughnuts. Because he made the initial investment, I owed him his money back, but I could keep the rest. This, he explained, was my "net profit." That simple lesson become the cornerstone of my relationship with money -- though it was hardly the last. My father continued my fiscal education with various "sneak attacks," notably requiring me to pay for 50 percent of my college education, which cultivated in me a deep appreciation of the value of money. But it worked: When I graduated college, I felt empowered instead of intimidated at the prospect of handling my own financial affairs. At no point did I feel I needed to get married in order to stay afloat financially. Never did I wish for a Prince Charming to ride up on horseback to my little New York City apartment and whisk me away. (OK, so maybe that would be nice -- but I don't Prince Charming.) Unfortunately, my story is far from the norm. Around the world, young women (and men) are being raised without much financial education, and only realizing how badly they need it after they've accumulated crushing debt, taken out too many loans, misused credit cards or missed paying bills. And even in our modern, egalitarian era, some young women are still being raised with the idea that they should rely on a husband to provide them with a financially sound future. According to Plan's International's "Because I am a Girl" campaign, each extra year a girl spends in secondary education increases her salary by between 15 percent and 25 percent. But encouraging girls to finish high school, go to college, and find good jobs is not enough. It's equally important that they gain a level of fiscal understanding. These young women need to feel confident handling their paychecks, saving for their futures, and stepping into the role of breadwinner for their families. It's time parents and educators placed the same level of importance on financial literacy as we do an understanding of literature, math and science. Both boys and girls should be raised to feel comfortable asking questions about money, beyond "how much is allowance?" Just as we're now coming around to teaching young men that the tasks of raising children aren't "women's work," we need to be sure we're not teaching girls to, one day, just rely on their husbands to handle the money. Just imagine: We could live in a society where teens made informed decisions about student loans, young adults used their credit cards for responsible purchases they could pay off, and the awful cycle of unnecessary debt was just a parable told to children at bedtime.

Alamy When I was growing up, no one ever called me a princess. My parents told me I was smart, funny, powerful and kind, but never "princess." Mom handed me a Nerf gun and dad taught me how to shoot a layup. I'd wander into my parent's room to see my father ironing his suit pants for work while my mother sat at her desk paying the bills. There were no bedtime stories about helpless girls who needed to be rescued. Instead, there were lessons about how I could rescue myself through education and financial literacy. The first lesson came in the summer of 1996, when my father took money right out of my 7-year-old hands. My jaw dropped in indignation and my Pocahontas sneakers stamped the ground. I demanded he hand over my fairly earned cash. After all, I had been the one who woke up at 6 a.m. to set up my Fisher-Price table to sell Krispy Kreme doughnuts. Embracing the entrepreneurial spirit young, I had seized upon my mother's yard sale as the perfect opportunity to venture into the business world and hone my sales technique. My 4-year-old sister and I sold doughnuts at the marked-up price of 50 cents apiece to the bargain hunters while my mom peddled our old goods. I felt I'd earned my $18. With a chuckle over my childish rage, my dad told me I owed my sister $2 in wages for helping me sell those doughnuts. Then, he took his cut. As he counted out the quarters I owed him, he explained that he had staked me the money to buy the doughnuts. Because he made the initial investment, I owed him his money back, but I could keep the rest. This, he explained, was my "net profit." That simple lesson become the cornerstone of my relationship with money -- though it was hardly the last. My father continued my fiscal education with various "sneak attacks," notably requiring me to pay for 50 percent of my college education, which cultivated in me a deep appreciation of the value of money. But it worked: When I graduated college, I felt empowered instead of intimidated at the prospect of handling my own financial affairs. At no point did I feel I needed to get married in order to stay afloat financially. Never did I wish for a Prince Charming to ride up on horseback to my little New York City apartment and whisk me away. (OK, so maybe that would be nice -- but I don't Prince Charming.) Unfortunately, my story is far from the norm. Around the world, young women (and men) are being raised without much financial education, and only realizing how badly they need it after they've accumulated crushing debt, taken out too many loans, misused credit cards or missed paying bills. And even in our modern, egalitarian era, some young women are still being raised with the idea that they should rely on a husband to provide them with a financially sound future. According to Plan's International's "Because I am a Girl" campaign, each extra year a girl spends in secondary education increases her salary by between 15 percent and 25 percent. But encouraging girls to finish high school, go to college, and find good jobs is not enough. It's equally important that they gain a level of fiscal understanding. These young women need to feel confident handling their paychecks, saving for their futures, and stepping into the role of breadwinner for their families. It's time parents and educators placed the same level of importance on financial literacy as we do an understanding of literature, math and science. Both boys and girls should be raised to feel comfortable asking questions about money, beyond "how much is allowance?" Just as we're now coming around to teaching young men that the tasks of raising children aren't "women's work," we need to be sure we're not teaching girls to, one day, just rely on their husbands to handle the money. Just imagine: We could live in a society where teens made informed decisions about student loans, young adults used their credit cards for responsible purchases they could pay off, and the awful cycle of unnecessary debt was just a parable told to children at bedtime.