BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Stocks Under $10 Set to Soar

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Stocks Insiders Love Right Now

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

Yoku Tudou

Nearest Resistance: $20

Nearest Support: N/A

Catalyst: Earnings

Yoku Tudou (YOKU) is seeing big volume this afternoon, after the Chinese online video website posted its first quarter numbers for investors. YOKU posted a 14-cent loss for the quarter, beating Wall Street's estimates. But the proof is in the pudding with earnings reactions, and so today's 8.6% selloff is a pretty good indication that investors aren't satisfied with the less worse loss.

YOKU has been a breakdown machine for the last several months, failing to catch a bid at several successive price floors. With today's breakdown violating yet another key support level at $20, this stock is a falling knife. It's best avoided for longs.

Marvell Technology Group

Nearest Resistance: $16.30

Nearest Support: $15

Catalyst: Earnings

Marvell Technology Group (MRVL) posted a strong set of earnings stats after the bell yesterday, a big factor in today's big volume session for the semiconductor stock. MRVL earned 27 cents last quarter, beating revenue expectations by a nickel. Next quarter, the firm expects to earn between 26 and 30 cents per share, results that come in at the top of analysts' expected range.

MRVL is mostly flat following its earnings call. Likewise, shares have been consolidating in a flat range for the last several months -- but that changes if buyers can muster the strength to push shares above $16.30 resistance. That's the next barrier that needs to get cleared for more upside in MRVL in 2014.

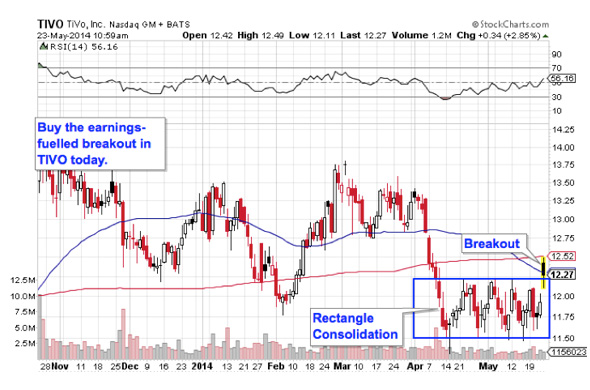

TiVO

Nearest Resistance: $13

Nearest Support: $12.25

Catalyst: Earnings

DVR maker TiVO (TIVO) is up modestly this afternoon, following the firm's fiscal first quarter 2015 numbers. TIVO earned 7 cents last quarter, beating expectations by a penny. Likewise, the firm posted subscriber numbers of 4.5 million, growth that eclipses the record the firm set back in 2006. That's a promising development for a firm that's been trying to innovate its way out of a long-term slump – and we're seeing that shift play out in shares this week.

TIVO broke out of a rectangle consolidation today, pushing its way above $12.25 -- now that level is acting as support. With no upside resistance until $13, now looks like a solid time to be a buyer in TIVO.

FireEye

Nearest Resistance: $40

Nearest Support: $25.50

Catalyst: Analyst Upgrade

2014 has been challenging for computer security firm FireEye (FEYE) -- after rallying hard at the start of this year, the mid-cap name made an about-face at the beginning of March, dropping like a stone. But shares caught a bid again early last week, and now an analyst upgrade from Barclays is tacking some upside onto this stock. A rounding bottom setup triggered earlier in the week, but it's only breaking the downtrend in shares today. With buyers in control of shares again, now looks like a good time to be a buyer -- just keep a tight stop in place.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>3 Stocks Spiking on Big Volume

>>5 Airline Stocks to Trade for Flyaway Gains in 2014

>>3 Stocks Under $10 Triggering Breakouts

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment